|

CLICK

HERE to download FREE Options Analyzer

Options as an alternative investment

Learn more advanced strategies than buy and hold..

Make money in down markets. Profit whether the stock goes

up or down. Try Options as an alternative investment.

Options give you a virtually unlimited number of profit

opportunities for ANY direction (up, down, choppy, or still) you think the stock is headed.

You can limit both your profits and losses. You can control

much larger quantities of stock for the same cost of buying the stock.

Option Basics

Perhaps you have invested in a 401k.

Maybe you have bought or sold stocks, bonds, or mutual funds.

Options can be the next step in your short or long term investment

strategies.

Different forms of options are used everyday. Why do you have

insurance on your

house and car? It's to protect your property from an unlikely

catastrophe for

a small amount known as a premium. In the same way some investors

buy options on stocks and indexes as insurance protection against

their holdings.

The biggest advantage of options is their flexiblity. They can be

as conservative or

speculative as your investment style needs to be. Here are some

examples of strategies you can do with options:

Protect

your existing stock or mutual funds from big declines. (buy puts)

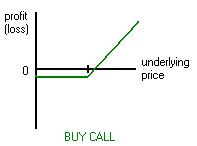

Profit

fully from a stock increase for a fraction of the cost. (buy calls)

Profit

generously from a stock increase for a smaller fraction of the cost.

(bull spread)

Take

in a monthly income from a stock you own. (covered calls)

Receive

a payment for the opportunity to buy a stock at a discounted price.

(put writing)

Profit

from a market move up OR down. (straddles)

Benefit

if the market stays still. (short straddles)

Buying Calls and Puts

The most fundamental options strategy is to buy call or buy puts.

First select a stock you are interested and go to an options chain

quote service such as:

The Chicago Board Options Exchange CBOE:

http://quote.cboe.com/QuoteTable.asp

Dreyfus Brokerage:

http://www.edreyfus.com

Type in the symbol and you will get a list of available options.

Here is an options chain for Microsoft on 11/7/01:

Select

an option you would like to purchase.

The Calls are on the left and Puts are on the right.

You will see the expiration date and exercise price for each option.

The premium quotes are listed under: last, bid, and ask.

In order to calculate the cost of the option, multiply the (premium)

x (number of contracts) x (100 shares per contract) Myths about

options

Myth 1:

"Options are very risky.. They are gambling"

While this can be certainly true for just buying options, option writing (or selling)

gives the investor many very conservative and high probability options strategies.

Options can even be used as insurance against existing stock positions.

Myth 2:

"Options are too complicated"

Understanding the basic option concept can be difficult at first. Read the intro

section for a very easy way to understand options.

Myth 3:

"Options are for rich people"

Buying options requires very little investment capital (under $1,000). Writing options account requirements

have dropped down to under $10,000 for many brokerages.

Myth 4:

"Options are rare and not easy to trade"

Options trading has exploded over the past 5 years. Now, options are available on over 2700 stocks.

All major online brokers now offer options trades as low as $1 a contract.

Myth 5:

"Most options expire worthless"

This can be true if there are more "out of the money" options than "in the money" and you are always the BUYER

of the option. If you become the SELLER of the options than you can take advantage of this. Options are "rain checks"

An option is a right to buy or sell an asset for a specified price and time.

Let's say you want to buy a TV on sale at Wal-Mart. You drive there only

to find out that it's "sold out". So you go to the clerk and ask for a

"rain check". This "rain check" is a guarantee that you will get the TV

for the sale price when they are back in stock. There may be an expiration

date on the "rain check" for 1 month from the out of stock date.

This rain check qualifies as an Call option. You have the right to purchase

the TV for the sale price up to 1 month regardless of how much the

TV goes up or down in price during that period. You are the buying this

call option and Wal Mart is the seller. The only difference of this

rain check versus a real option is that there is NO value on this option and

it is probably non-transferable.

Now, let's use this same concept for a stock. For instance, you want to

buy Microsoft stock and it is trading at $50 a share. Instead of buying the

stock, you decide to purchase a "right to buy the stock at 50" which will

expire on 1/15/01. You would be willing to pay $3 for this right to buy Microsoft

before 1/15/01 at $50. On the other side of this deal, there is someone

who is willing to sell you this right for you to buy Microsoft from him for 50.

He wants $3 for granting you this contract.

Comparison table: Stock option VS Rain check for TV

|

Option components: |

|

Stock |

|

Rain check for TV |

|

Expiration Date |

|

1/15/2000 |

|

1/15/2000 |

|

Strike (exercise) price |

|

50 |

|

500 |

|

Call (buy) or Put (sell) |

|

call |

|

call |

|

Option price |

|

3 |

|

NO VALUE (non transferrable) |

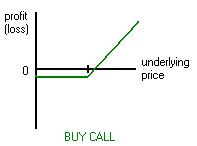

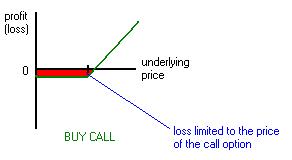

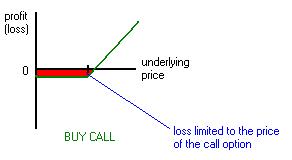

Buying a Call option and the power of leverage

In the previous example, we are buying a Microsoft 50 Call Option for $3.

This would be the right (but not the obligation) to buy Microsoft for $50 on or

before the expiration date. On expiration, if Microsoft is below $50 the

option expires worthless and you would lose your $3.

If it is anywhere above $50, you would profit dollar per dollar less your $3 cost.

A profit loss table for 1 call option contract (100 shares, total cost: $300) would look as follows:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| p/l at exp |

-300 |

-300 |

-300 |

-300 |

700 |

1700 |

2700 |

| p/l% at exp |

-100% |

-100% |

-100% |

-100% |

233% |

567% |

900% |

The same $300 investment in buying MSFT would have got you only 6

shares:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| p/l at exp |

-180 |

-120 |

-60 |

0 |

60 |

120 |

180 |

| p/l% at exp |

-60% |

-40% |

-20% |

0% |

20% |

40% |

60% |

As you can see, the power in buying options involves controlling

substantially more shares for the same cost. You also limit your

maximum risk to the lower cost of the option. The only

downside to buying options is that your probability is high that the

stock will stay the same resulting in you losing some or all of your

option value.

CLICK

HERE to analyze a Call Option

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt (if prompted)

(3) click 'Enable Macros' to run program

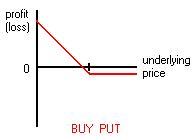

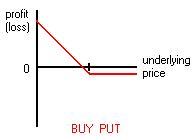

Buying Put Options

Buying put options are the same strategy as buying calls, only

betting the stock will go down instead of up. So the you could buy a

50 Put Option for $3. This would be the right to SELL Microsoft for

$50 before the expiration date. On expiration, if Microsoft is above

$50, the option expires worthless and you would lose your $3.

If it is anywhere below $50, you would profit dollar per dollar less

your $3 cost.

A profit loss table for 1 put option contract (100 shares, total

cost: $300) would look as follows:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| p/l at exp |

2700 |

1700 |

700 |

-300 |

-300 |

-300 |

-300 |

| p/l% at exp |

900% |

567% |

233% |

-100% |

-100% |

-100% |

-100% |

CLICK

HERE to analyze a Put Option

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt

(3) click 'Enable Macros' to run program

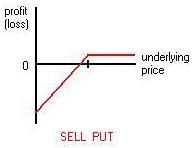

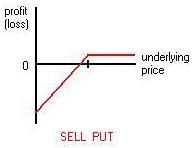

Writing options for high probability investing

Naked Puts

A "naked put" is simply selling or writing a put option

instead of buying it.

Here, you would be selling a 50 put for $3. You would give someone

else the

right to sell you the stock for $50 on or before expiration for a $3

credit.

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| p/l at exp |

-2700 |

-1700 |

-700 |

300 |

300 |

300 |

300 |

| p/l% at exp |

-900% |

-567% |

-233% |

100% |

100% |

100% |

100% |

Here your loss would be almost unlimited and your profit would be

limited to $300.

The probability would be high that the stock would stay the same or

go up giving you the $300 profit.

Covered Calls

A "covered call" has the same exact profit and loss

table as a naked put.

Here you would buy 100 shares of a $50 stock and sell (write) a 50

call for $3.

Basically, selling the 50 call would give someone the the right to

buy the stock

from you for $50 on or before expiration. In return for granting

this, you will

receive $3. Should the stock close above $50 at expiration, you

would end up

selling your stock to that person for $50 and profiting $300. If the

stock is

below $50, you would still own it and keep the $300.

CLICK

HERE to analyze a Covered Call

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt (if prompted)

(3) click 'Enable Macros' to run program

Buying a put as insurance for an existing stock position

If you own an existing stock and are worried that there may be

huge correction

in the short term, you can buy a put to insure the stock against

such a catastrophe.

For example, you own 100 shares of a stock with a current price of

$50.

You buy a 40 put for $1 which expires in one month. Should the stock

drop toward $40 on or before expiration, your profits from the put

could offset the losses on the stock.

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| stock pl |

-3000 |

-2000 |

-1000 |

0 |

1000 |

2000 |

3000 |

| put option pl |

2900 |

1900 |

900 |

-100 |

-100 |

-100 |

-100 |

| NET pl |

-100 |

-100 |

-100 |

-100 |

900 |

1900 |

2900 |

The put will limit your total losses to only $100 (cost of the

put) reduce your gains by the same amount.

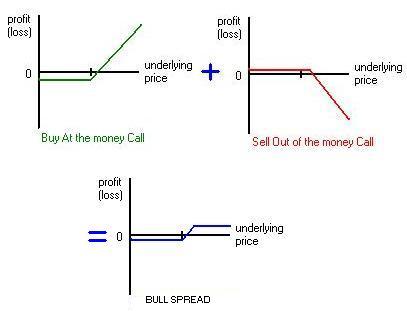

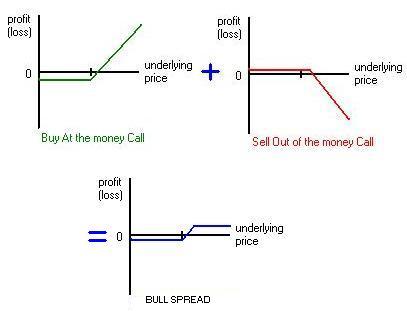

Bull Spread - a conservative option play

A more conservative approach to just buying a call would be the

bull spread.

This involves buying one call and selling another call further out.

For example, a stock is trading at $50 and you buy the 50 call for $3

and sell the 60 call for $1.

This would result in a spread position where you max loss and profit

are limited. The max

profit would be $800 and the max loss would be $200 (net cost).

The PL at expiration table would look as follows:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| buy

50 call@3 |

-300 |

-300 |

-300 |

-300 |

700 |

1700 |

2700 |

| sell

60 call@1 |

100 |

100 |

100 |

100 |

100 |

-900 |

-1900 |

| net

pl |

-200 |

-200 |

-200 |

-200 |

800 |

800 |

800 |

This position in comparision to just buying the call, would give

you a lower maximum risk and limit the max profit to $800.

CLICK

HERE to analyze a BULL

SPREAD

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt (if prompted)

(3) click 'Enable Macros' to run program

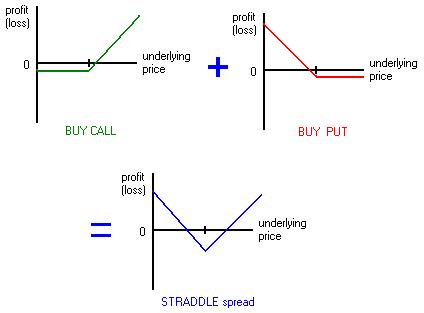

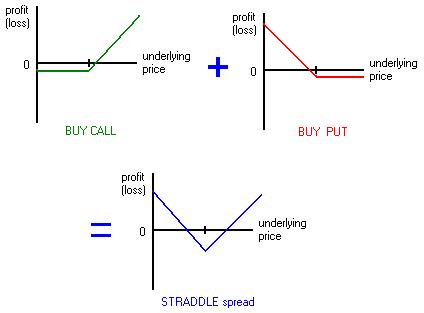

Straddle - Making money up or down

A straddle option spread allows you to make money whether the stock

moves up OR down. It is simply combining a buy put and buy call

option. The Straddle will only lose if the stock stays the same.

The PL at expiration table for a STRADDLE would look as follows:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| buy 50 call@3 |

-300 |

-300 |

-300 |

-300 |

700 |

1700 |

2700 |

| buy 50 put@3 |

2700 |

1700 |

700 |

-300 |

-300 |

-300 |

-300 |

| net pl |

2400 |

1400 |

400 |

-600 |

400 |

1400 |

2400 |

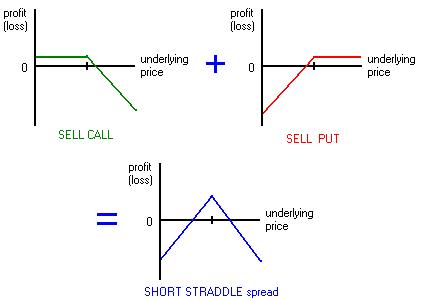

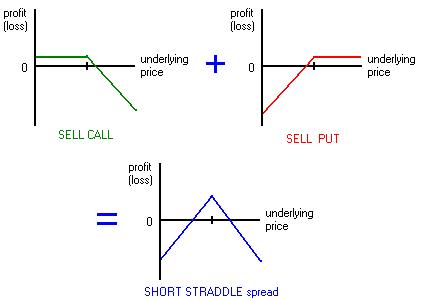

Short Straddle - Making money if the Stock stays the same

A Short Straddle is the opposite of the straddle. It is combining a

SELL call and SELL put option.

The PL at expiration table for a SHORT STRADDLE would look as

follows:

| stk

price |

20 |

30 |

40 |

50 |

60 |

70 |

80 |

| sell 50 call@3 |

300 |

300 |

300 |

300 |

-700 |

-1700 |

-2700 |

| sell 50 put@3 |

-2700 |

-1700 |

-700 |

300 |

300 |

300 |

300 |

| net pl |

-2400 |

-1400 |

-400 |

600 |

-400 |

-1400 |

-2400 |

CLICK

HERE to analyze a STRADDLE

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt (if prompted)

(3) click 'Enable Macros' to run program

SUMMARY TABLE: Basic Option Strategies TABLE

| STRATEGY |

Options |

|

DIRECTION |

MAX

PROFIT |

MAX

RISK |

| |

Components* |

|

|

|

|

|

|

| Buy Call |

bc |

|

very

bullish |

unlim |

|

cost of

option |

| Buy Put |

bp |

|

very

bearish |

unlim |

|

cost of

option |

| Sell Call |

sc |

|

moderate

bearish |

cost of

option |

unlim |

|

| Sell Put |

sp |

|

moderate

bullish |

cost of

option |

unlim |

|

| Covered Calls |

bu+sc |

|

moderate

bullish |

cost of

option |

unlim |

|

| Bull Spread |

bac+soc |

|

bullish |

|

strike

spread |

cost of

options |

| Bear Spread |

bap+sop |

|

bearish |

|

strike

spread |

cost of

options |

| Straddle |

bc+bp |

|

volatile |

|

unlim |

|

cost of

options |

| Short Straddle |

sc+bc |

|

neutral |

|

cost of

options |

unlim |

|

| *Option Component Abbreviation table |

|

|

| |

|

|

|

|

|

| buy

at the money call (bac) |

sell at

the money call (sac) |

| buy

at the money put (bap) |

sell at

the money put (sap) |

| |

|

|

|

|

|

| buy

out of the money call (boc) |

sell out

of the money call (soc) |

| buy

out of the money put (bop) |

sell out

of the money put (sop) |

| |

|

|

|

|

|

| buy

in the money call (bic) |

sell in

the money call (sic) |

| buy

in the money put (bip) |

sell in

the money put (sip) |

CLICK

HERE to analyze a CUSTOM

POSITION

(requires Microsoft Excel to run)

(1) click 'Open' at save file prompt

(2) click 'Cancel' at username password prompt

(if prompted)

(3) click 'Enable Macros' to run program

CLICK

HERE to download Optionstar EZ (options analyzer)

(requires Microsoft Excel to run)

(1) click 'Save' at save file prompt

(2) click 'Cancel' at username password prompt

(if prompted)

(3) In Windows, Double click on OSEZ.exe file

(4) Click 'Extract' in the directory you

want the file to go to.

(5) Double click on the file or open it from Excel.

|