Options Insurance

In the USA, we don't think twice

about driving our car without collision

insurance OR owning a house without fire

insurance.

This past year, we have seen a big "fire"

in the market and one has to ask..

would mkt "fire" insurance helped in hindsight ?

Can options be used as an insurance

policy against your portfolio ?

The answer of course, is yes.

Options were invented for that purpose

but gained more of a "risky" reputation

as traders used them not has insurance

but instead as "lottery tickets".

Based on the number of shares and sectors your portfolio

has.. you can easily match it with the corresponding options.

You could even use ETFs to cover sector baskets.

For simplicity, let's say your portfolio is best represented as 100

shares of SPY (S&P 500).

The next question to ask is time horizon.

Option price decay is exponential (moves faster closer to expiration)

so longer term options are priced less per month than shorter term.

For example: an at the money put for spy 30 days out is $3

the same put 2.5 yrs out (12 '11) is $18... less than 1 per month.

If you plan on keeping this protection strategy for 2 continuous years, it

would be a better value to use the 2 yr options instead of

"renewing" shorter term ones.

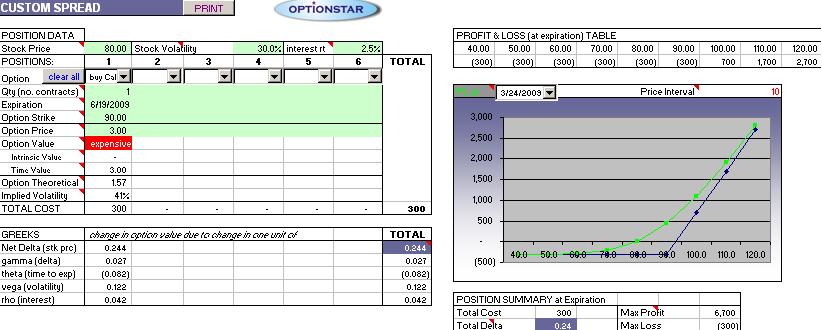

Let's say we want insurance for the next 3 months, so we will

choose Jun 09 Spy options. (Today is 3/23/09)

For simplicity, the prices have been rounded off.

SPY current price is 80.

Jun 09 option prices are as follows:

strike call put

60 21 1

70 12 3

80 6 6

90 3 12

100 1 21

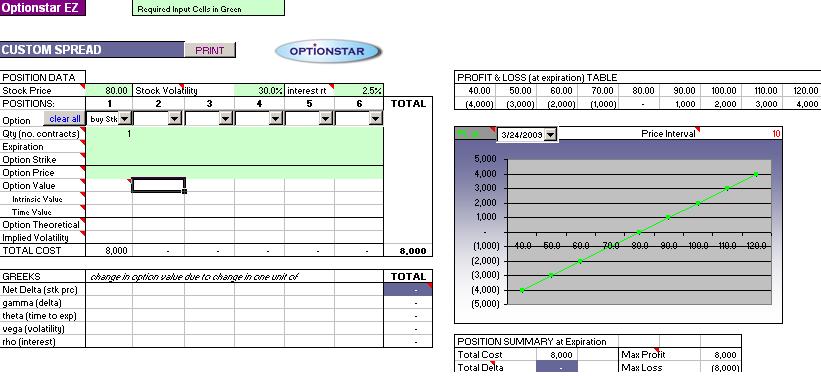

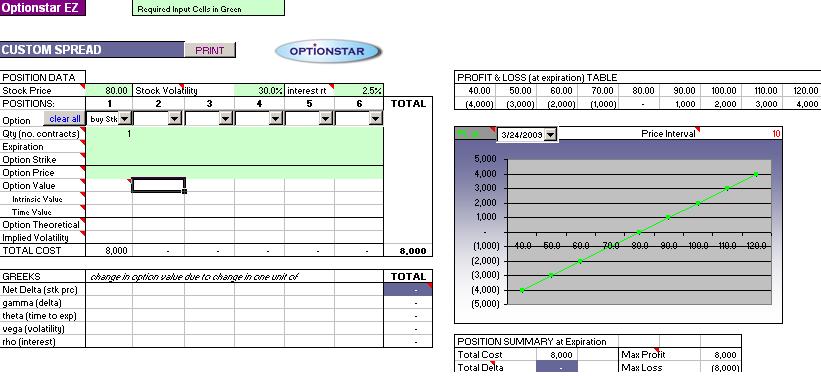

If we had 100 shares of SPY, the profit loss VS price graph of our

portfolio would be a 45 degree line with $100 of profit for every $1 of price movement:

So there is no downside protection. If SPY were to lose 50%, you would lose the same.

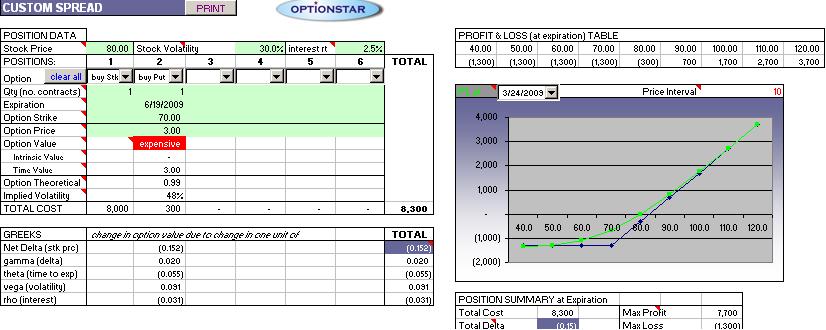

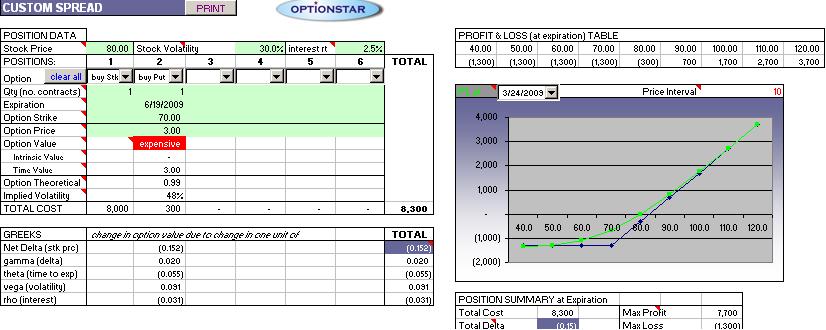

Buying an equivalent share quantity of Put options would stop our losses at the put strike.

For example, buying one 70 put with this position (100sh of spy@80) would stop (offset) our losses at 70.

Our losses would be limited to $1300 or 16% (1300/8300).

Our profits would be begin at 83 (current stock price 80 + option price 3).

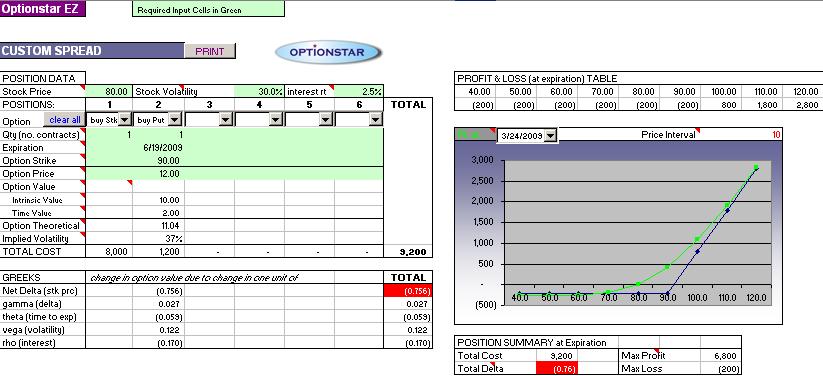

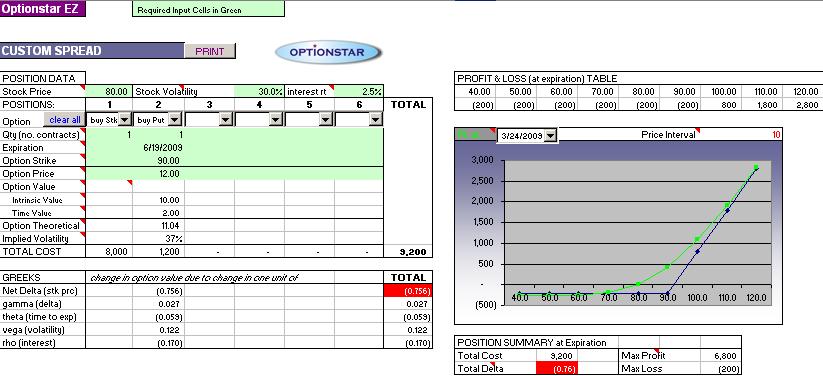

Buying one 90 put with this position (100sh of spy@80) would stop (offset) our losses at 90.

Our losses would be limited to $200 or 2.5% (200/8000)

Our profits would be begin at the (current stock price 80 + option price 12) or 92.

SUMMARY

Spy at a current price of 80, 90day options

max loss breakeven

100sh spy + buy 60p@1 2100 81

100sh spy + buy 70p@3 1300 83

100sh spy + buy 80p@6 600 86

100sh spy + buy 90p@12 200 92

100sh spy + buy 100p@21 100 101

The tradeoff is between max loss and breakeven price.

The smaller the max loss, the greater the breakeven price.

Greater protection reduces probability of profit.

All are good loss protection strategies. Choose based on

how likely you think the crash will occur and at what price.

Keep in mind that the (long underlying + buy put) spread is equivalent to buying a call.

So what we are doing here when we buy puts as insurance against our underlying portfolio

is temporarily (until option expiration) turning our long position into a call strategy

(limit our risk at a cost of reduced but still unlimited reward)

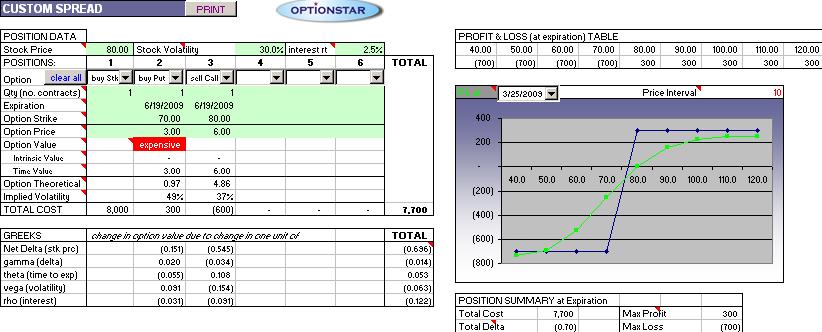

ADDITIONAL PROTECTION:

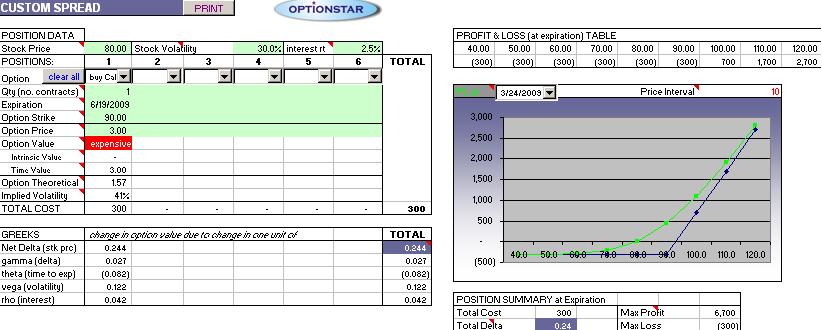

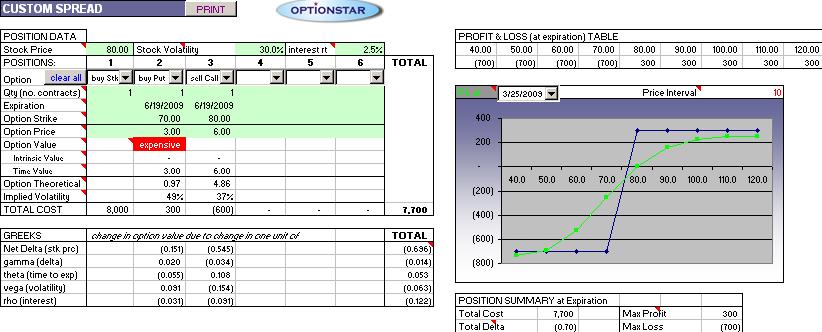

COLLAR (buy stk + buy put + sell call)

We can add selling a 80 call to our above protection strategy: (buy stock + sell 70p)

This will reduce our max loss from $1300 to $700 and are break even from 83 to 77

at the cost of a max reward of $300.

Collars strategies are the same as vertical spreads: (buy call + sell

call*) or (buy put + sell put*) *different strike prices

Just like buying puts against owning a stock turns it into a temporary call,

buying puts and selling calls against a stock turns it into a temporary vertical spread.