LOSS RECOVERY

We have seen that options can be used as protection against future losses.

Options can also be used to accelerate loss recovery on a stock

that has crashed and moving back up.

Let's say we bought SPY at 100 and are down to 80.

We would be happy just to breakeven at this point without

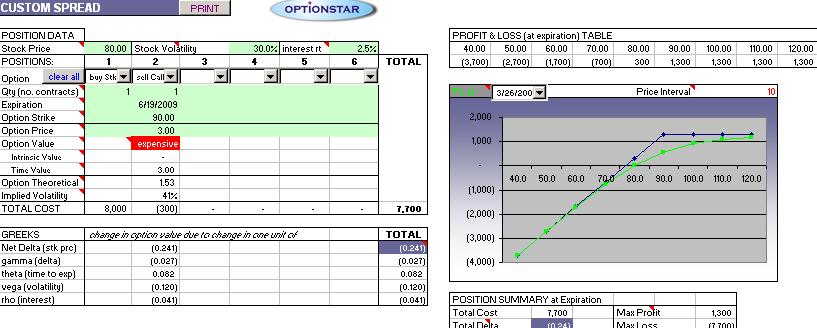

any additional risk. The options you would add to your SPY

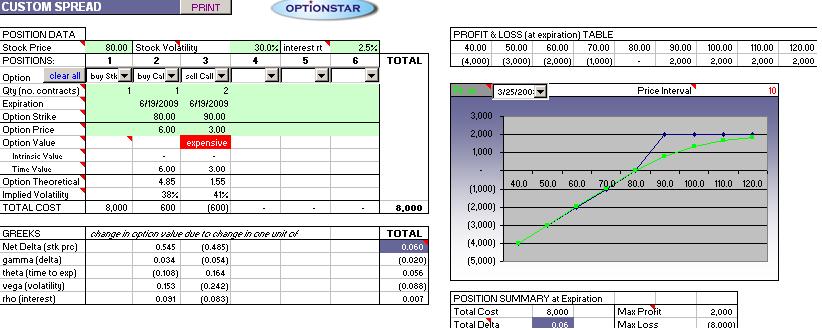

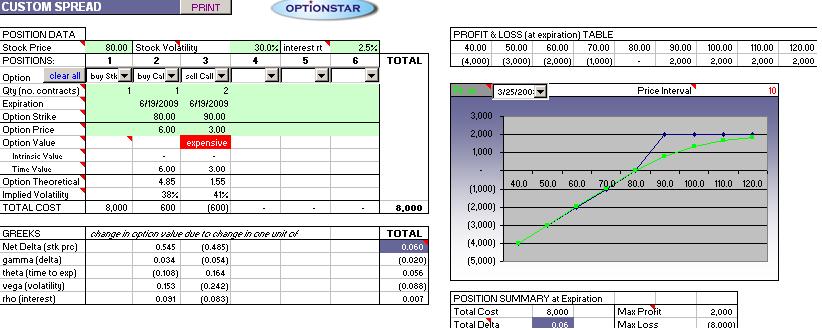

stock would be: buy 1 80 call + sell 2 90 calls

This would create a position where the downside risk below 80

would be the same as just owning the stock. If it goes up

to 90, you get recover your entire $2000 loss instead of having to wait to 100

on just owning the stock. The cost would be that you would not gain

anymore after 90.

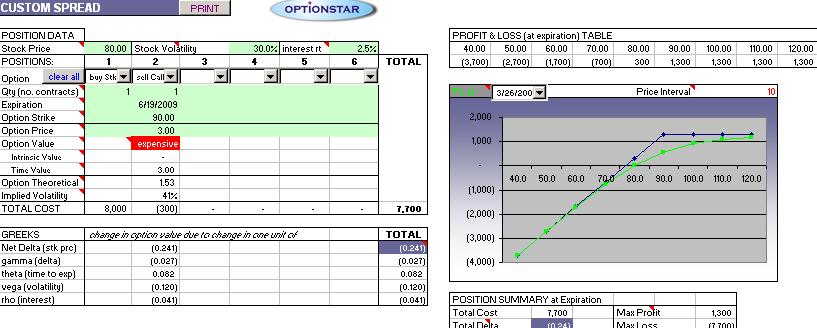

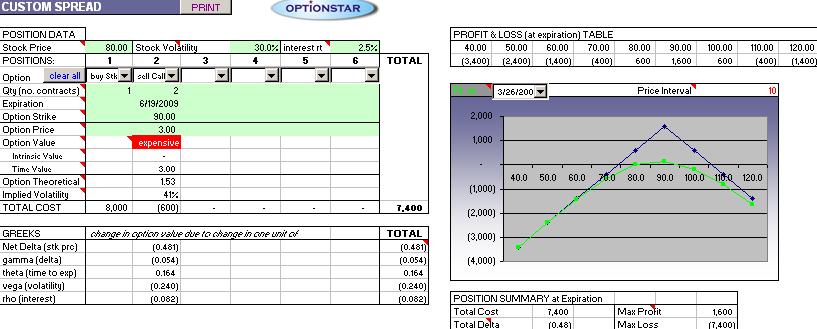

A simpler loss recovery strategy can be to sell a call against your losing stock position or "Covered Call"

Below, we sold one 90 put @ $3 againist our 100sh of spy.

The downside risk below 80 will be reduced by $300. Our gains would stop when spy hit 90 where we

could recover at most $1300 of our loss.

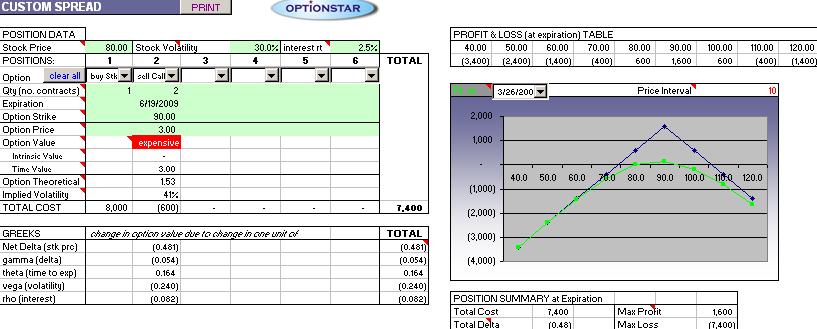

If you sell another 90 call on this 100sh spy position, your downside risk is reduced

again by another $300 (option price) and you can recover $1600 of your loss if the SPY

were to be right at 90 during expiration.

The upside risk however, becomes unlimited if spy goes past 90.. break even is 106.

Loss recovery methods need to be carefully chosen to avoid,

additional risk both up and downside.