Options Analysis Software for Excel |

||||

|

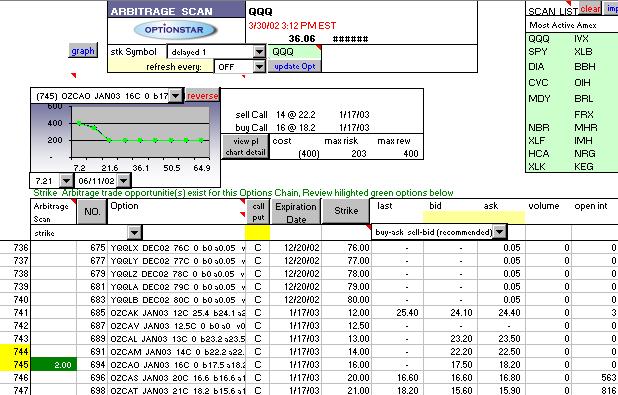

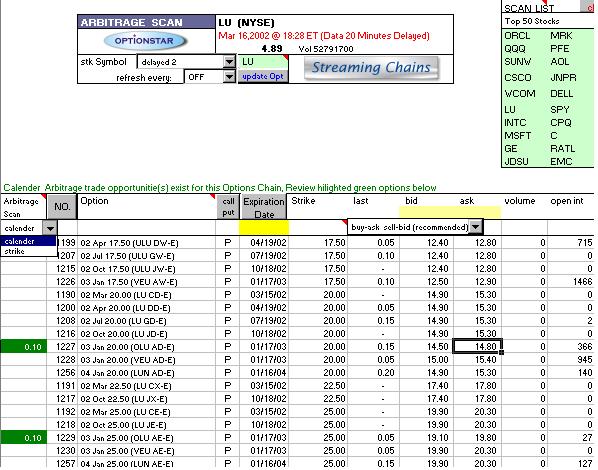

Overview - Spread Scanner - option chain analysis |

||||

| General | Optionstar | Spread Scanner | Streamer | Arb Scanner | Testimonials | The Competition | ||||

|

|

|

|||

| Copyright 2002 Star Research, Inc. |

|

Neither Star Research,

Inc. nor Optionstar software make trading recommendations. None of the

charts or information contained in these pages should be construed as a solicitation to trade any of these strategies. In addition, none of the prices contained in the graphs are current. All data is provided solely as theoretical examples for informational purposes. Consult a qualified options broker before assuming a position you are unfamiliar with. There is risk of loss in all trading. |