Introducing the Risk Free Trade Scanner

Not yet seen in most of the major options packages are risk free (arbitrage) trade scans.

This product allows you to find the arbitrage opportunities that exist in many options chains throughout the day.

Arbitrage opportunities are instances where the price of a particular option is much higher than its "neighboring"

strike price or near month options. These instances can create risk free spreads where you can generate at least a small

profit at expiration no matter what price the underlying settles.

This product brings to you opportunities that have been traditionally available only to specialists and floor traders.

It is available now for a very affordable price of $99.

The Scanning Process

The scanning process works as follows:

Simply select an underlying stock/index symbol that you want to scan the options chain for and the

number of times you want the scan to repeat until a risk free opportunity comes up. The scanner

will automatically datafeed the options chain in 20 minute delayed and an alarm will sound

if an arbitrage comes up. The risk free options will be highighted in yellow and the PL graph will automatically

be displayed. You can select multiple stock/index symbols to scan for up to 5.

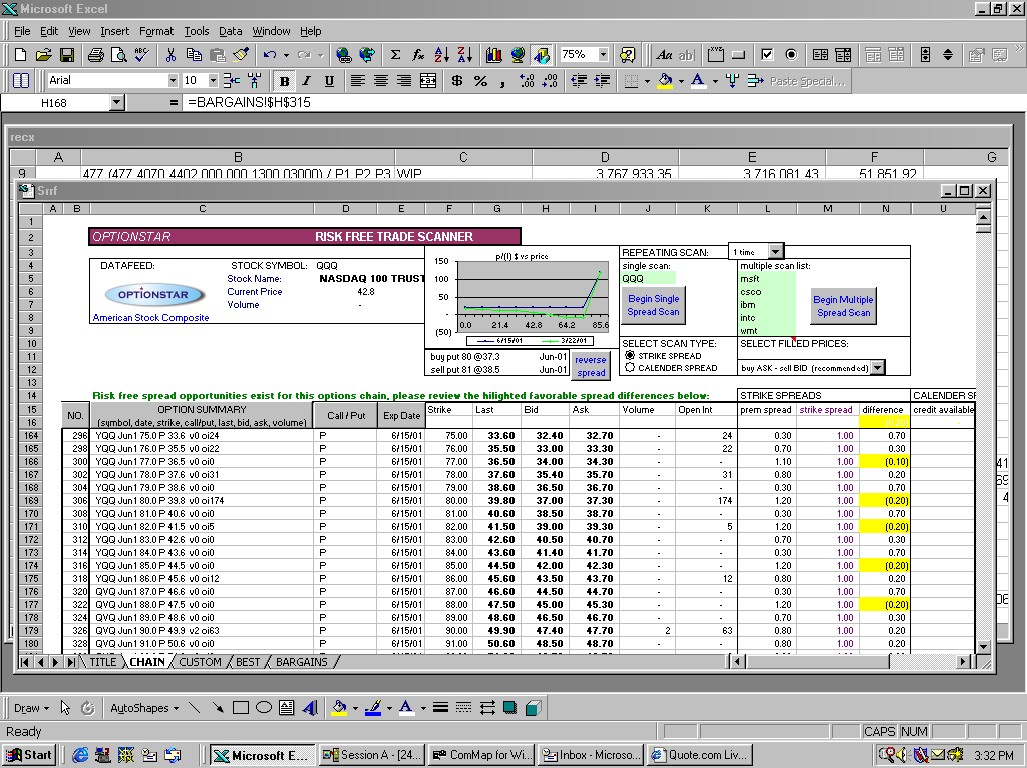

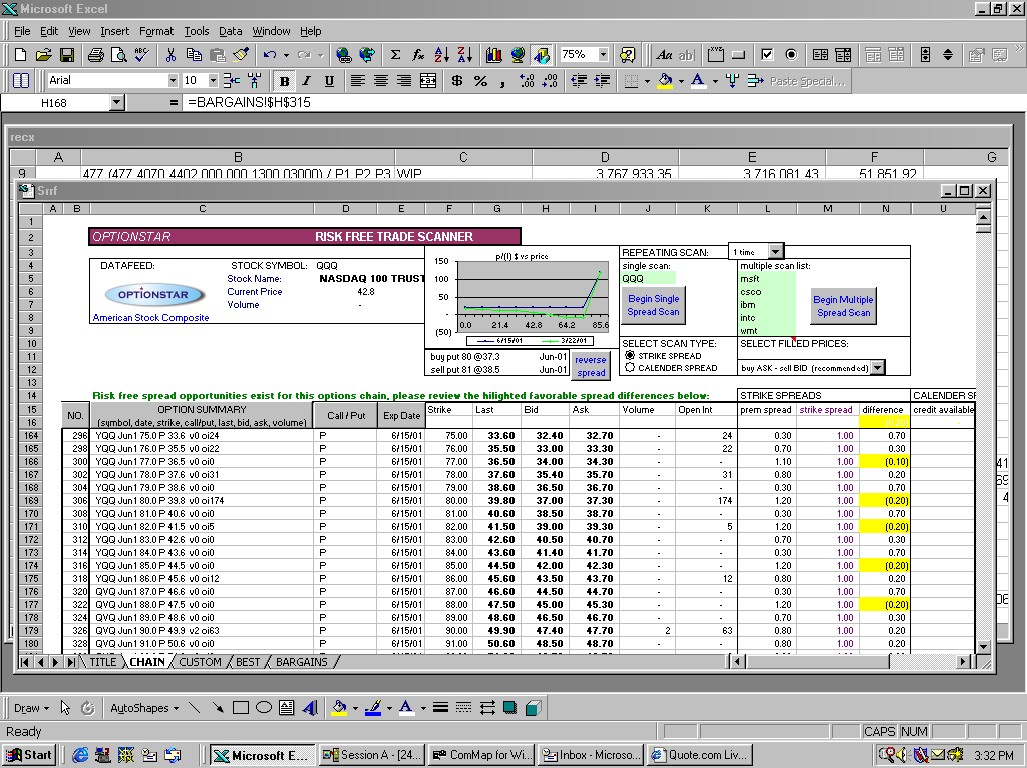

Risk free trade: Example 1. (strike spread)

QQQ 3/22/01

On the afternoon of 3/22/01, the nasdaq rallied and brought QQQ up two points from 40 to 42.

This surge in volatility caused many discrepancies in the option premiums for neighboring strikes in the Jun-01

deep in the money put options. Namely, the 80 put dropped in price faster than the 81 put causing

a temporary condition where the premium spread was 1.2 and a strike spread of 1. You could generate

at least $20 per contract on this spread even if you got filled conservatively by: "buying the Ask and selling the Bid".

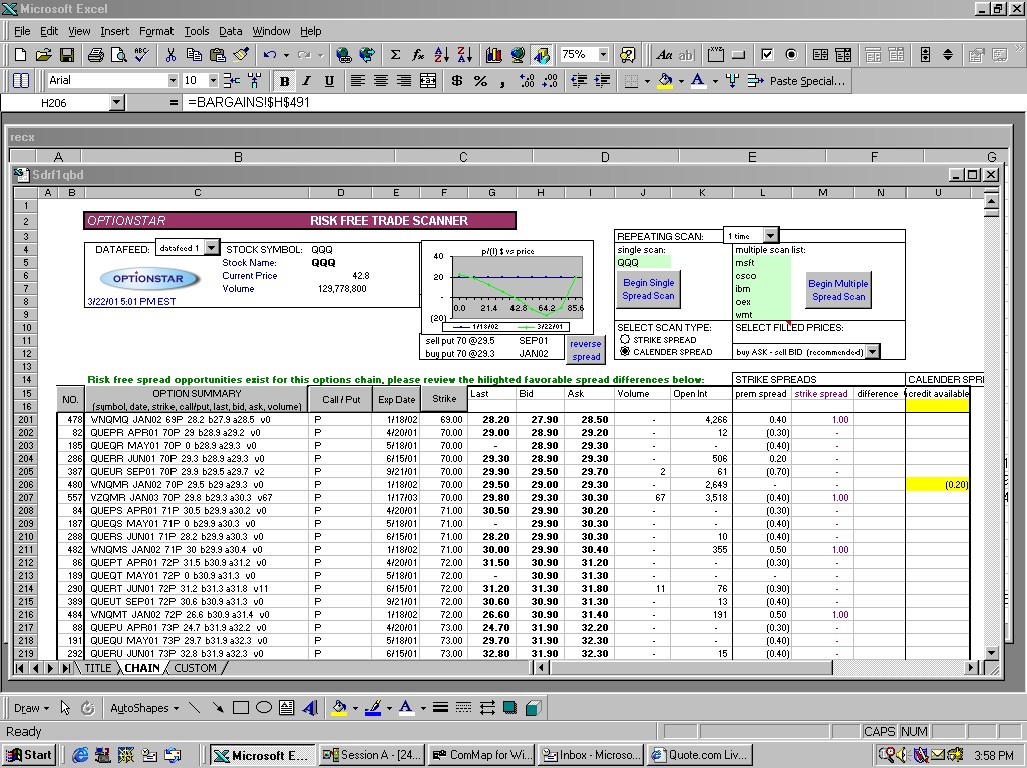

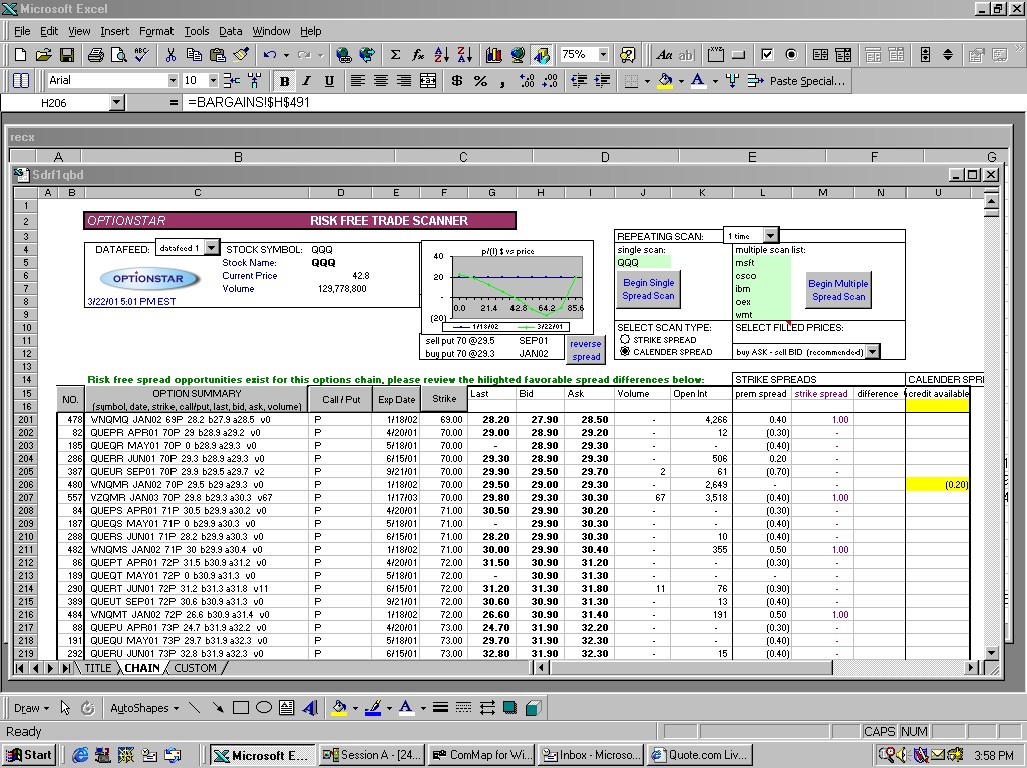

Risk free trade: Example 2. (calender spread)

QQQ 3/22/01

QQQ moved sharply on 3/22/01.

This caused a fluctuation in the 70 puts where the Sep 2001 temporarily spiked to be more valuable the the Jan 2002 by .20

or $20 per spread contract.

Risk free trade: Example 3. (strike spread)

LU on 3/30/01

LU on 3/30/01 chopped between 9.5 and 10.

Late in the afternoon a risk free strike spread opportunity formed between the apr-01 27.5 and 30 puts.

You could have picked up an incredible .60 or $60 per contract spread on this arbitrage.

risk free trade scanner special notice:

All trade opportunities identified with this program

are based on quote sources believed to be reliable,

but accuracy is NOT guaranteed.

Please verify these quotes with your broker before

placing any actual trades.

The user accepts the program information on the

condition that no claim, demand, or cause of

action can be made against it.

BACK

TO TOUR MENU

|